Copy Trading Revolution:

Learn from the Best and Earn Big

Copy the Moves of Top Traders and Watch Your Portfolio Grow

Hey there! Copy trading has become a true game-changer in the world of forex trading. By mirroring the strategies of successful traders, you can harness their expertise and potentially achieve significant returns. In 2024, advanced copy trading platforms are making it easier than ever to get started. Let’s dive deep into how you can leverage copy trading to grow your portfolio and thrive in the dynamic forex landscape.

Copy trading has revolutionized the way individuals engage with forex trading. Traditionally, trading required extensive market knowledge, continuous monitoring, and the ability to make quick decisions. However, not everyone has the time or expertise to do so. This is where copy trading steps in, allowing you to follow and replicate the trades of seasoned professionals.

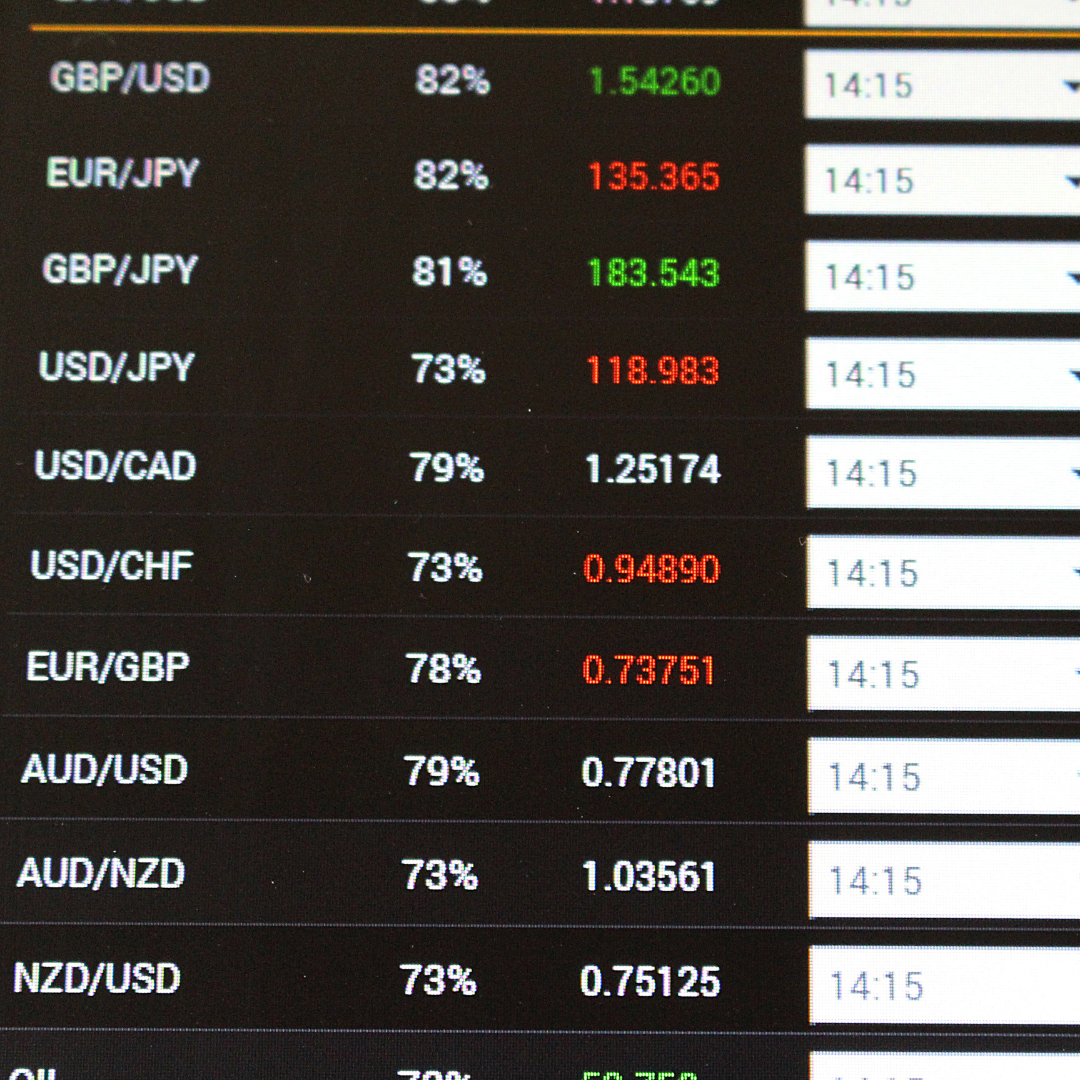

Copy trading platforms connect investors with experienced traders. When you opt to copy a trader, the trades they execute are automatically mirrored in your account. This means you benefit from their expertise and strategies without having to make the trading decisions yourself. The process is transparent, and you can see the performance metrics of the traders you’re copying.

In 2024, several advanced copy trading platforms offer a range of features to enhance your trading experience. Look for platforms with user-friendly interfaces, robust security measures, and detailed performance metrics. Some popular platforms include eToro, ZuluTrade, and CopyTrader. These platforms provide tools to analyze trader performance, risk levels, and historical data, helping you make informed decisions.

Choosing the right traders to copy is crucial for your success. Start by analyzing their track record, risk profile, and trading strategy. Look for traders with consistent performance, low drawdowns, and a trading style that aligns with your risk tolerance. It’s also beneficial to diversify by copying multiple traders to spread your risk and increase your chances of success.

Setting Up Your Copy Trading Account

Setting up your account is a straightforward process. Begin by registering on your chosen platform and depositing funds into your trading account. Next, browse through the list of traders and select those you wish to copy. Allocate a portion of your funds to each trader based on their performance and your risk appetite. Most platforms allow you to adjust your allocations and stop copying traders at any time.

Benefits of Copy Trading

Learning Opportunity: Copy trading provides a valuable learning opportunity. By observing the strategies and decisions of successful traders, you can gain insights into market analysis, risk management, and trade execution.

Time-Saving: Copy trading saves you time and effort. Instead of spending hours analyzing the market and monitoring trades, you can rely on experienced traders to make decisions on your behalf.

Diversification: Copy trading allows you to diversify your portfolio by copying multiple traders with different strategies. This diversification helps spread risk and enhances your chances of success.

Accessibility: Copy trading makes forex trading accessible to individuals with limited experience. You don’t need to be an expert to participate and profit from the market.

Risks and Challenges

Market Volatility: Forex markets can be highly volatile, leading to rapid changes in trading conditions. It’s crucial to stay informed and adapt to market fluctuations.

Dependence on Traders: Your success in copy trading depends on the performance of the traders you’re copying. If they make poor decisions, it can impact your portfolio.

Platform Risks: Ensure you choose a reputable copy trading platform with robust security measures to protect your funds and personal information.

Case Study: Successful Copy Trading in 2024

Let’s explore a case study of a successful copy trading journey in 2024. Meet Jane, a busy professional with limited time for trading. She decides to try copy trading on a popular platform. After researching and selecting a few top-performing traders, she allocates her funds accordingly.

Over the next few months, Jane closely monitors the performance of the traders she’s copying. She makes adjustments as needed, reallocating her funds to traders with consistent returns. By following a diversified approach and practicing risk management, Jane achieves significant returns on her investment.

Exposing Broker Secrets and Industry Standards

In the world of forex trading, not all brokers have your best interests at heart. Many brokers profit when you lose, creating a conflict of interest. They may offer enticing bonuses, fancy trading tools, and platforms to lure you in, but their primary goal is to keep you trading and losing.

When choosing a broker for copy trading, prioritize transparency, regulation, and a good reputation. Look for brokers that offer fair trading conditions, low spreads, and excellent customer support. Avoid brokers with high hidden fees and questionable practices.

n 2024, staying updated with market trends and news is crucial for successful copy trading. Economic indicators, policy changes, and global events can significantly impact currency movements. Follow reputable financial news sources, subscribe to market analysis reports, and join trading communities to stay informed.

Copy trading offers a powerful way to leverage the expertise of successful traders and achieve significant returns in the forex market. By understanding the fundamentals of copy trading, choosing the right platform and traders, and practicing risk management, you can embark on a profitable trading journey in 2024. Remember to stay informed, diversify your portfolio, and continuously monitor your investments. Join our community of traders and start copying the moves of top traders today!