Forex Trading in 2024: Navigating a Dynamic Market Landscape

Stay Ahead with Expert Insights and Cutting-Edge Strategies

Hello, fellow trader! The forex market in 2024 is like an ever-changing ocean, full of waves that we need to navigate with precision. If you're reading this, you likely understand the incredible potential of forex trading but also the challenges that come with it. Let’s dive deep into understanding this dynamic market and how you can thrive by staying informed and prepared.

The Ever-Changing Forex Market

Imagine the forex market as the largest and most liquid financial ocean globally, with trillions of dollars flowing daily. In 2024, this ocean is more dynamic than ever, influenced by economic, political, and technological waves. To surf these waves successfully, you need to be adaptable and well-informed

Economic indicators are like the compass for our journey. They provide valuable insights into the health of an economy and influence currency movements. Key indicators to watch this year include GDP, inflation rates, unemployment rates, and interest rates. These indicators help us understand the strength of different economies and, consequently, their currencies.

GDP measures the total economic output of a country. Higher GDP growth rates indicate a strong economy, often leading to a stronger currency. Inflation rates, on the other hand, measure how fast prices for goods and services are rising. Central banks use interest rates to control inflation, and these rates are crucial for currency traders. Higher interest rates attract foreign investments, strengthening the currency.

Unemployment rates are another vital piece of this puzzle. Low unemployment rates usually mean a healthy labor market, which can strengthen a currency. Conversely, high unemployment can lead to currency depreciation. Central banks' interest rate decisions play a pivotal role here. Higher rates can strengthen the currency by attracting foreign investment, while lower rates might lead to depreciation.

Navigating Policy Changes and Global Events

In 2024, global events and policy changes are like the hidden reefs and currents in our ocean. Geopolitical tensions, trade agreements, and central bank policies can all impact currency values. Staying informed about geopolitical developments and their potential effects is crucial. Trade agreements, tariffs, and central bank announcements must be on your radar.

For instance, political instability or conflicts can create market uncertainty and impact currency movements. Keeping an eye on these developments can help you anticipate and react to market changes effectively.

To navigate these waters, mastering market analysis is essential. Fundamental analysis involves understanding economic indicators, policy changes, and global events to grasp their impact on currency movements. It’s about reading the currents and understanding where they might lead.

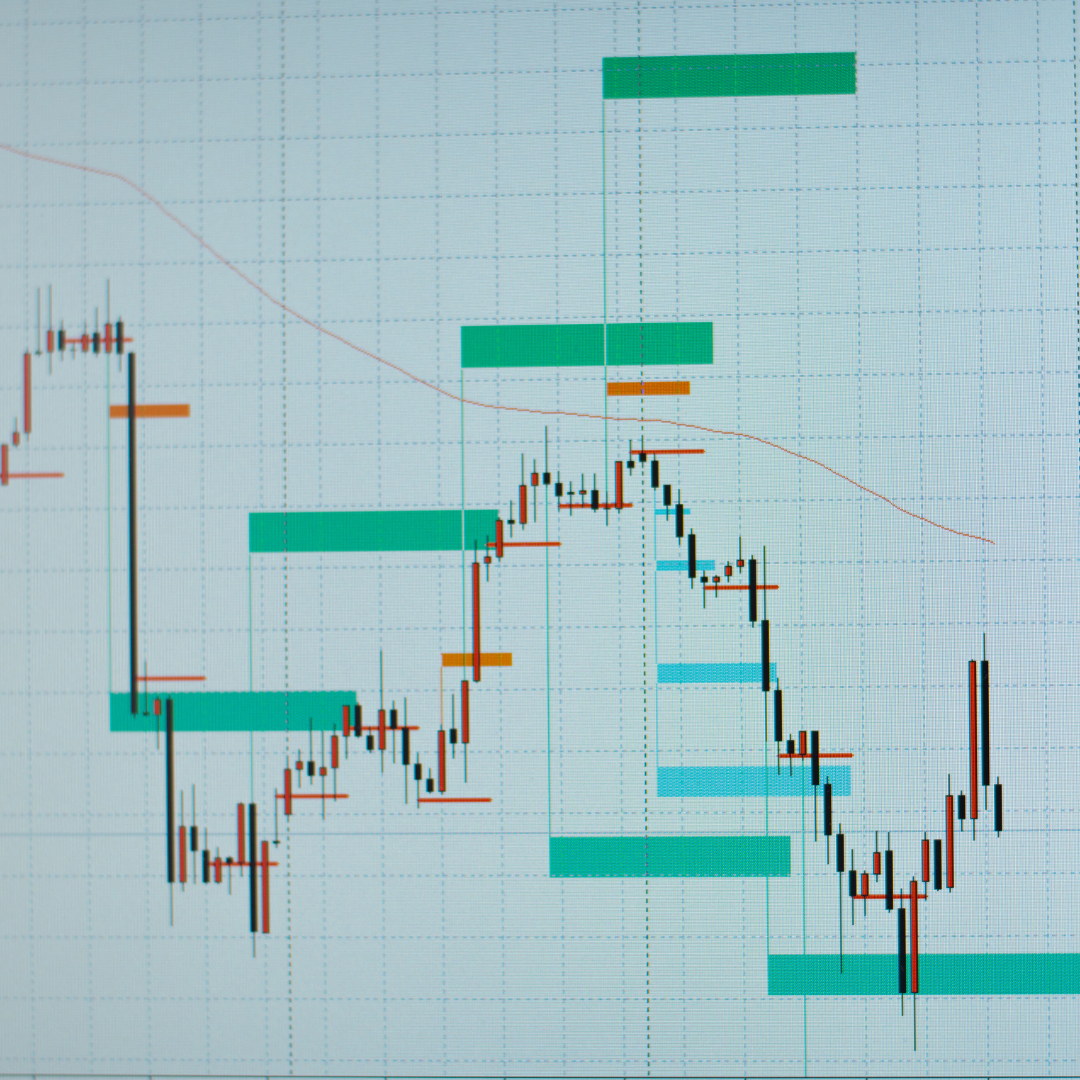

Technical analysis, on the other hand, is like studying the waves. Use charts and indicators to analyze historical price movements and identify trading opportunities. Tools like moving averages, support and resistance levels, and trendlines can be incredibly helpful.

Sentiment analysis gauges the market’s mood. Indicators like the Commitment of Traders (COT) report can help you understand market sentiment, anticipate price movements, and make informed trading decisions.

Developing a Robust Trading Strategy

A successful trading strategy combines these elements. In 2024, some popular strategies include trend following, range trading, breakout trading, and carry trading.

Trend following involves trading in the direction of the prevailing trend, using technical indicators to confirm entry and exit points. Range trading works well in stable markets, where you buy at the lower end of the range and sell at the upper end. Breakout trading focuses on trading the breakout of key support or resistance levels. Carry trading takes advantage of interest rate differentials between currencies, borrowing in a currency with low rates and investing in one with higher rates.

Risk Management and Emotional Discipline

Risk management and emotional discipline are like our life jackets in this ocean. Position sizing is crucial—determine the size of your trades based on your risk tolerance and account size. Never risk more than a small percentage of your account on a single trade.

Stop-loss orders are your safety nets, limiting potential losses on each trade. Set your stop-loss levels based on your analysis and stick to them. Aim for a favorable risk-reward ratio to ensure profitable trades outweigh losses.

Emotional discipline is perhaps the toughest challenge. Control emotions like fear and greed to avoid impulsive decisions. Develop a trading plan and follow it consistently. Be patient, wait for the right trading opportunities, and avoid overtrading. Quality trades are more important than quantity. Be flexible and adjust your strategy based on market conditions. Continuous learning and improvement are essential for success.

Case Study: Navigating the Forex Market in 2024

Let me share a story. Imagine trading the USD/JPY pair during a major Bank of Japan announcement. By analyzing the market sentiment and using technical indicators, you predict a bullish move. You execute a trade and manage it effectively, achieving significant profits. This case study highlights the importance of staying informed, analyzing market trends, and applying your strategy with discipline.

Common Mistakes to Avoid

Overtrading is like trying to ride every wave—exhausting and risky. Focus on quality over quantity. Overtrading can lead to increased transaction costs and emotional exhaustion. Ignoring risk management is a sure path to significant losses. Always use stop-loss orders and manage your risk. Chasing losses by taking larger risks is a dangerous game. Stick to your trading plan and remain disciplined. Avoid falling for market hype—rely on your analysis and strategy.

The forex market is dynamic, and continuous learning is essential. Stay updated with market trends, attend webinars, and seek mentorship from experienced traders. Invest in your education and keep refining your skills.

Navigating the dynamic forex market in 2024 requires a combination of expert insights, cutting-edge strategies, and emotional discipline. By staying informed about key economic indicators, policy changes, and global events, you can develop robust trading strategies that adapt to changing market conditions. Remember to prioritize risk management, maintain emotional discipline, and continuously improve your skills. With dedication and the right approach, you can thrive in the ever-changing forex landscape.